9

PM Modi On GST: Many important decisions have been taken in the 56th meeting of GST Council. During this period, 5 and 18 percent tax slab has been approved. Since then, many goods have been made tax free.

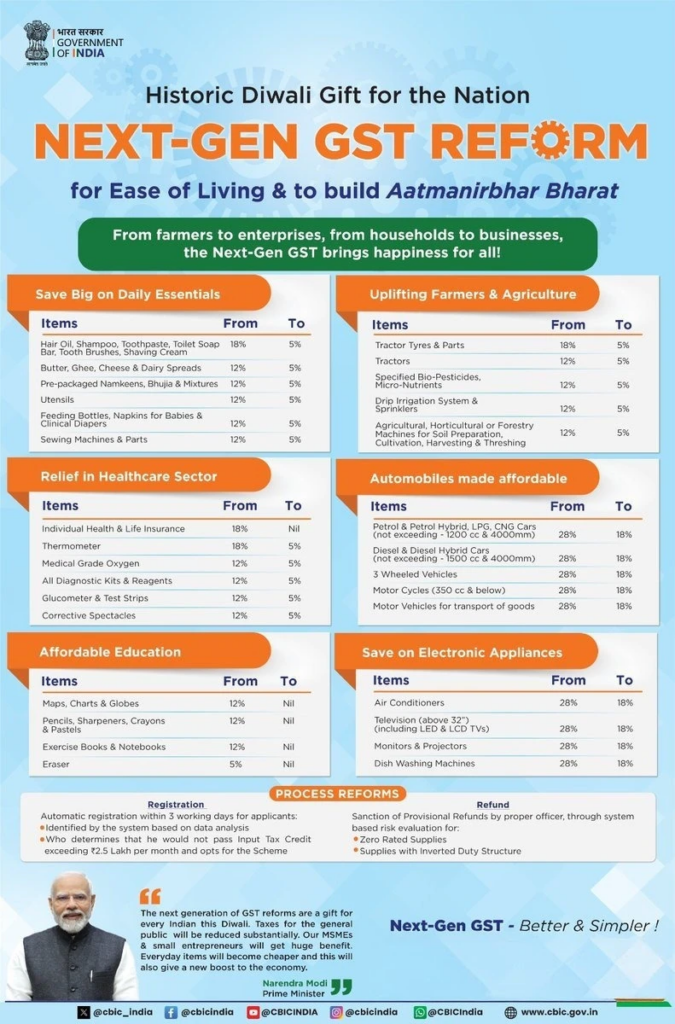

PM Modi On GST : Many important decisions have been taken in the 56th meeting of GST Council. The government has given a big gift to the public before Deepawali. Their direct impact is being seen from common people to traders, during this time they have got relief. It was decided in the meeting that 5 and 18 percent tax slab has been approved. That is, 12 and 28 percent slabs have been abolished. Since this decision of the central government, everyday items will be cheap and medicines have been completely excluded from tax. Among the things that have fallen in the price, there are many things including roti, cheese and milk which have been made GST free.

Finance Minister gave information

Union Finance Minister Nirmala Sitharaman shared information about it after the meeting. He informed that along with daily items, medicines and education related goods have also been made tax free. However, there are many things on which GST has been reduced. GST has been reduced from 18 percent to 5 percent on some parts of the tractor. Earlier, 12 fasting taxes were levied on this, but now only 5 percent will be taken.

GST will not be applied on these food items

Giving information about the change in the tax slab, Finance Minister Nirmala Sitharaman said that the food items which used to be 5 to 18 percent earlier have been abolished. These included ready to eat bread, ready to eat paratha, all types of breads, pizza

Paneer, UHT milk and chhena are included. Here, let us know that the tax on goods like milk bottles, kitchen utensils, tooth powder, umbrellas, bicycles, bamboo furniture and comb has been reduced from 12 percent to 5 percent.

There will be no tax on education related goods

The government has also given relief to the students. The government has also made the goods related to education tax free. There are many things including pencil, rubber and cutter that are outside the scope of GST. These include things like pencil, rubber, cutter, notebook, globe, map, practice book and graph book.

Changes in medicines and health insurance also

This decision of the central government has brought great relief to the common people. The government has made many medicines tax free. At the same time, health-life policy has also been excluded from the purview of GST. In the GST Council meeting, 33 life saving medicines GST have been abolished. Earlier, 12 percent tax was levied on them.

Also read: GST Update: GST Council meeting starts today, many things can be cheaper; Can be big…

PM Modi told this decision historic

After this decision, PM Modi shared the post on social media platform X and described it as a historic decision. He wrote that GST reforms for the upcoming generation will make the life of the common man easier and will further strengthen the economy. He further wrote that during Independence Day on August 15, I had talked about improving the next generation in GST.

Posted shares also

A poster has also been shared by the government regarding GST slab. It has been told in this poster that how much GST will be taken on what things. PM Modi also has a message for the country on this poster. It was said that the next generation of GST reforms is a gift for this Deepawali every Indian.

Also read: Immigration rules: Government’s big decision for minorities, permission to stay in India