22

The government will appoint trained women of self -help groups (SHG) at the gram panchayat level as ‘Insurance Sakhi’.

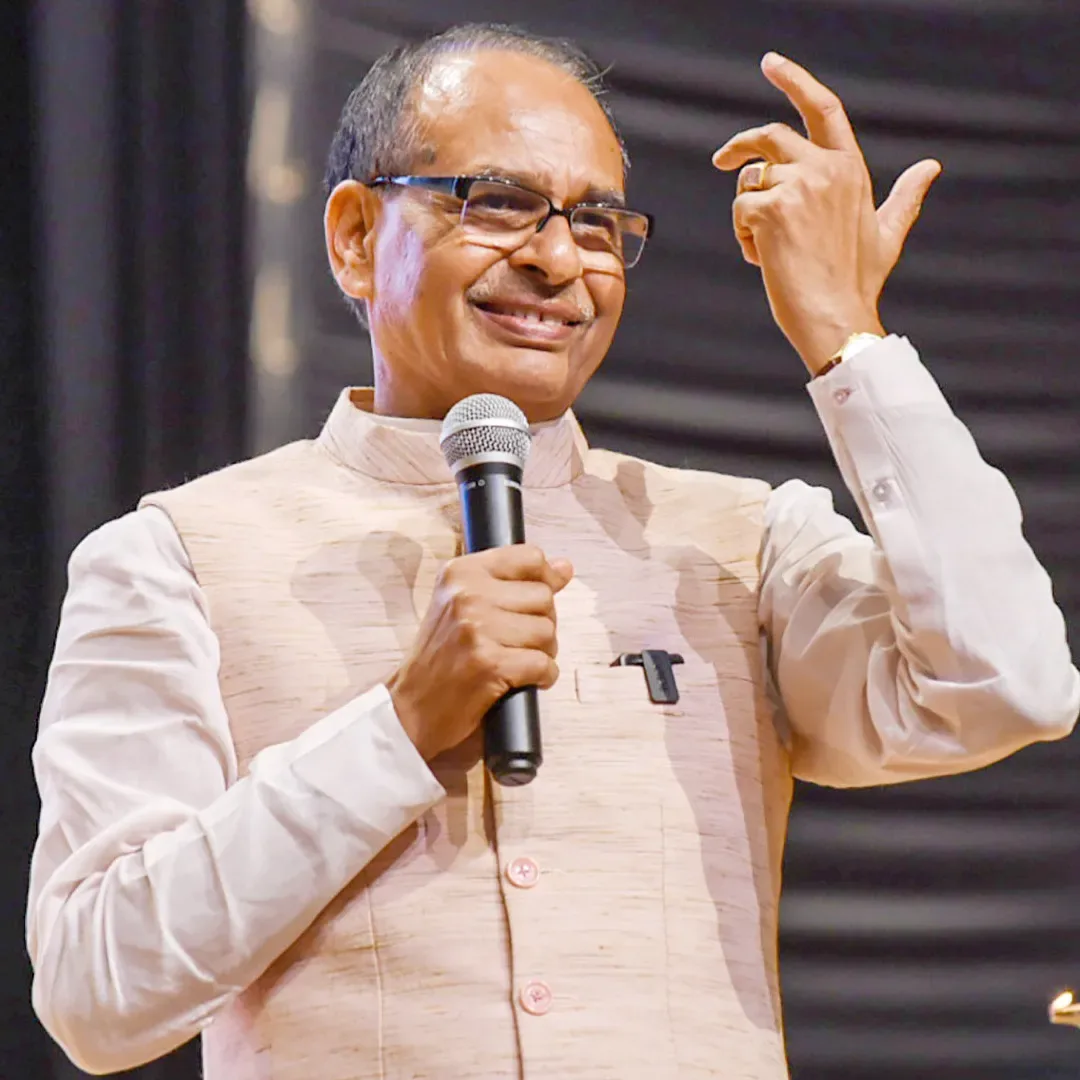

New Delhi: Union Rural Development and Agriculture and Farmers Welfare Minister Shivraj Singh Chauhan on Saturday described the launch of ‘Insurance Sakhi Yojana’ as a historic step. He said that this is an important step of the government towards women empowerment and economic security in rural and semi-urban India. Speaking at this program, he credited the leadership of Prime Minister Narendra Modi for this transformational initiative, which is in line with the government’s ‘Insurance for all till 2047’. The Ministry of Rural Development will appoint trained women of self -help groups (SHG) as ‘Insurance Sakhi’ at the Gram Panchayat level under the financial inclusion initiative of the National Rural Livelihood Mission in partnership with Life Insurance Corporation of India (LIC). These insurance Sakhi will promote insurance schemes, provide confidence-based services in remote areas and promote financial freedom among rural women.

2 crore millionaire’s target till 15 August

Chauhan emphasized that this scheme not only supports entrepreneurship but also carries forward the Lakhpati Didi Mission, which aims to make 2 crore (20 million) millionaires by August 15. Describing the Insurance Sakhi Yojana as a powerful platform for women entrepreneurship, the minister highlighted the Sustainable Development Target 5 (gender equality) and highlighted the ‘self -sufficient India’. This initiative is expected to promote local employment, increase women’s participation in workforce and provide financial security to rural families, especially in disaster affected areas. It is also aligned with government programs like public safety and digital India, supporting the skill development of women. Chauhan called insurance stories a “precursor to social change”, and mentioned his role in increasing access to insurance in villages and increasing economic flexibility.

Financial security shield of crop insurance farmers

On the other hand, the Union Minister also said that the Jagan government did not give crop insurance for three consecutive years, but the government gave its share on time. Chauhan told the House that if the state does not give his share on time, then he will have to deposit 12% interest along with his share. Let us know that the Prime Minister Crop Insurance Scheme was started by Prime Minister Narendra Modi in 2016. Crop insurance is a financial security shield of farmers who provide compensation to farmers in the event of loss of crops, so that they can maintain their livelihood. In a country like India, where agriculture is mainly dependent on rainfall, drought, flood, hailstorm, storm or untimely rain can destroy crops.

Also read: Maulana Rashidi, SP workers slapped after giving controversial statements on Dimple Yadav